It’s super important that we understand the new health care changes that went into effect on September 23, 2010. Why? Because they’re now your legal rights. If an insurance company is not complying with these regulations, you can and should hold them accountable so you get the maximum protection and coverage guaranteed to you by law.

I love the Campaign for Better Health Care and have used their guide adapting it slightly for young adults and cancer patients. If you have additional questions, ask in the comment section below and I’ll bring an expert on board to make sure we get them answered.

Lastly, please forward, tweet, and re-post this Everything Changes blog post widely. (Here’s a link you can just cut and paste http://ow.ly/2M6GR) Lots of people are understandably confused and I want to make sure that all patients get the maximum coverage we are guaranteed. After all this increased access to care can save patients money and even save lives.

Read on!

Kairol Rosenthal

* * *

Below are changes that apply to plans beginning or renewed after September 23, 2010. For many people this means the provisions actually take effect when they renew their plans in early 2011.

1. COVERAGE FOR YOUNG ADULTS

If you’re a YA without health insurance, you can be covered under your parent’s insurance plan up until your 26th birthday. This includes YAs who are married and YAs who aren’t students.

FYI: Young adults that already have a health insurance offer through an employer may not be eligible.

2. FREE PREVENTIVE CARE

Your insurance plan must cover preventive services and screenings, without co-pays or deductibles. Here are just a few of the preventive services and screenings on the list that I thought pertained to young adults and cancer patients. You can view the full list too.

- Depression screening

- BRCA counseling about genetic testing for women at higher risk

- Breast Cancer Chemoprevention counseling for high risk women

- Cervical Cancer screening for sexually active women

- Sexually Transmitted Infection prevention counseling

- STI screenings for syphilis, Chlamydia, Gonorrhea

- Immunizations for adults – including HPV, influenza, and pneumonia

- For pregnant women: folic acid supplements, breast feeding support, screening for hepatitis b and anemia plus much more – see the list

- Alcohol misuse screening and counseling

- Obesity screening and counseling for all adults

- Tobacco Use screening and cessation interventions for tobacco users

- Diet counseling for adults at higher risk for chronic disease

FYI: Colorectal screenings were for age 50 and over; mammograms for age 40 and over. However, I suggest you challenge your insurance company to cover these if you are younger and medically in need of these tests. (See below for your right to appeal insurance company decisions.)

“Grandfathered” plans don’t have to comply with this rule. To learn more about what a grandfathered plan is visit FamiliesUSA and read the 4th item under ‘Big Picture’.

3. NO MORE LIFETIME CAPS

Insurers are now not allowed to set limits on your lifetime benefits coverage, no exceptions. This means you will no longer have to worry about “capping out” on your coverage.

FYI: While there are no more lifetime limit caps, there are still annual benefits caps that have been raised to $750,000. These will be fully eliminated in 2014.

4. NO MORE RESCISSIONS

Insurance companies are no longer able to cancel your coverage for unjust reasons, a practice known as rescission. Before, if an insurance company got hit with a big claim, they could find an unintentional error on your application (even from years ago) and use it as a basis to deny you coverage; not anymore. This this this applies to all insurance plans.

FYI: If you intentionally commit fraud or hide something on your application, your insurance company can still rescind your coverage.

Your insurance company must give you 30 days notice if they intend to rescind your coverage, in order to give you time to appeal.

5. RIGHT TO APPEAL INSURANCE COMPANY DECISIONS

You’ll now have the right to appeal decisions your insurance company makes about your health care (such as refusing coverage) to an independent, third party reviewer. How this appeals process actually works will vary by state and by plan.

FYI: This doesn’t apply to grandfathered plans.

6. NO MORE DENYING KIDS WITH PRE-EXISTING CONDITIONS

This applies for children up to age 19. So if you’ve got kids, read this one carefully. Insurers are required to provide coverage to children with pre-existing conditions, such as asthma or hemophilia. This applies to families with group plans and non-grandfathered individual plans.

FYI: Grandfathered individual plans do not have to comply with this provision (though group plans DO), and some insurance companies will no longer offer child-only policies.

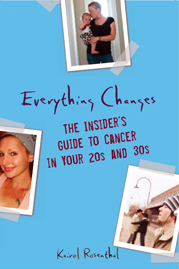

These new changes are an incredible step in the right direction for our country. They will help me and many, many people I know. But they will not cover everyone yet, and some patients will still need extra financial support. Check out Everything Changes: The Insider’s Guide to Cancer in Your 20s and 30s for financial assistance resources for cancer patients.

![]()

![]()

“Everything Changes is, without doubt, the most forthright, emotionally sophisticated, and plain-old valuable book of its kind I've seen.”

“Everything Changes is, without doubt, the most forthright, emotionally sophisticated, and plain-old valuable book of its kind I've seen.”